Unpacking the Australian Property Investor Sentiment Report Q4 2023

Property sentiment reports play a critical role in the real estate industry, offering valuable insights into market trends, investor sentiment, and future outlooks. The Australian property market is driven by sentiment.

Sentiment, in the context of the property market (or any other financial market), refers to the overall attitude or feeling of investors, buyers, or participants towards a particular asset, market, or economic conditions. Sentiment encompasses perceptions, emotions, and beliefs that influence your decision-making processes.

Is it a good time to buy? Should I buy my own home or buy an investment property? Where should I buy an investment property? What type of property should I be purchasing?

These are just some of the questions unpacked in the Australian Property Investor Magazine’s Property Sentiment Report, compiled by editor, Craig Francis. For investors looking to make informed decisions in the property market, understanding these reports is key.

If you want to hear Craig unpack the changing priorities of property investors and spotlight emerging regional markets, offering a glimpse into the future of property investing in Australia, you can listen to the full podcast episode here.

First Things First, What are Property Sentiment Reports?

Property sentiment reports are comprehensive analyses of the real estate market that provide insights into property investment patterns. These reports typically include data on market trends, investor attitudes, economic indicators, and forecasts for future market conditions.

By compiling and analysing this data, property sentiment reports aim to offer a comprehensive overview of the current state of the property market and provide you guidance on potential opportunities and risks.

Property sentiment reports, such as the Australian Property Investor Magazine’s Property Sentiment Report, are invaluable decision-making tools for investors in the real estate market.

By providing insights into market conditions and investor sentiment, these reports help you make informed decisions about when, where, and how to invest in property.

Property sentiment reports also play an important part in risk management, allowing you to assess the potential risks associated with your investment decisions and make adjustments accordingly.

How Property Sentiment Reports are Compiled

Australian Property Investor Magazine’s property sentiment reports are compiled using survey responses provided by their readers. Surveys are often conducted among real estate professionals, investors, and other stakeholders to gauge their sentiments and expectations regarding the property market.

Once the data is collected, it undergoes thorough analysis to generate insights and trends. Statistical analysis, trend analysis, and comparative analysis are common methods used to interpret the data and identify patterns and trends in the property market.

Key Metrics and Indicators

Property sentiment reports often include key metrics and indicators that provide valuable insights into the property market.

Buyer Intent

Seller Intent

Market Confidence

Economic Indicators

Top Finds for Q4 2023

The Australian Property Investor Magazine’s Property Sentiment Report for Q4 2023 gives valuable insights into Australian property investment trends, investor sentiments, and emerging opportunities across Australia’s property landscape.

The Australian Property Investor Magazine’s full Property Sentiment Report Q4 2023 can be downloaded here.

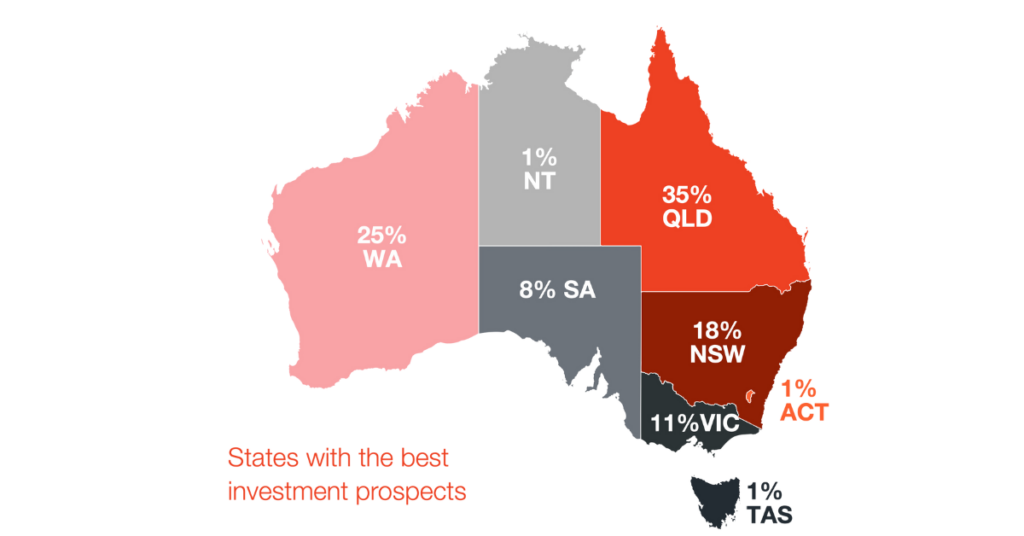

Western Australia is an Emerging Investment Location

Western Australia has become a prominent player in the Australian property market, particularly Perth, which has seen a remarkable surge in dwelling values, up by 15.2% in 2023.

This growth has attracted both investors and potential migrants seeking promising investment opportunities and more affordable entry points into the market. With forecasts predicting further price increases, Perth is increasingly appealing to investors looking for lucrative returns.

The demand is so high that properties are being snapped up by interstate buyers even before locals have a chance to consider them. The low supply of properties has led to soaring rent prices, further fueling investor interest as they seek high rental yields and capital growth. However, there is a caveat – Perth’s property market is closely tied to mining commodity prices, and a rapid drop could quickly end its momentum.

Queensland is Still the First Choice for Property Investors

Queensland remains a top choice for property investors, especially Brisbane, which saw a solid annual property growth rate of 13.1% in 2023. More people are recognising Queensland as a prime investment opportunity, boosting confidence in its market. With Brisbane’s strong performance and promising regional markets, investors can expect significant returns in the years ahead.

Long-term Investment Strategies

Investor sentiment is shifting noticeably towards long-term investment strategies, which is a significant change from previous trends. This shift highlights the importance of careful and forward-thinking investment strategies that align with your long-term financial goals. The data shows a substantial increase in the proportion of Australian investors prioritising retirement planning, from just 5% to nearly 19% in the past year.

This trend is particularly interesting given that the Australian Property Investor Magazine’s readership predominantly consists of young adults aged 25 to 44 which suggests a growing awareness of superannuation and long-term financial planning among younger demographics, despite the current challenges of high interest rates and affordability issues.

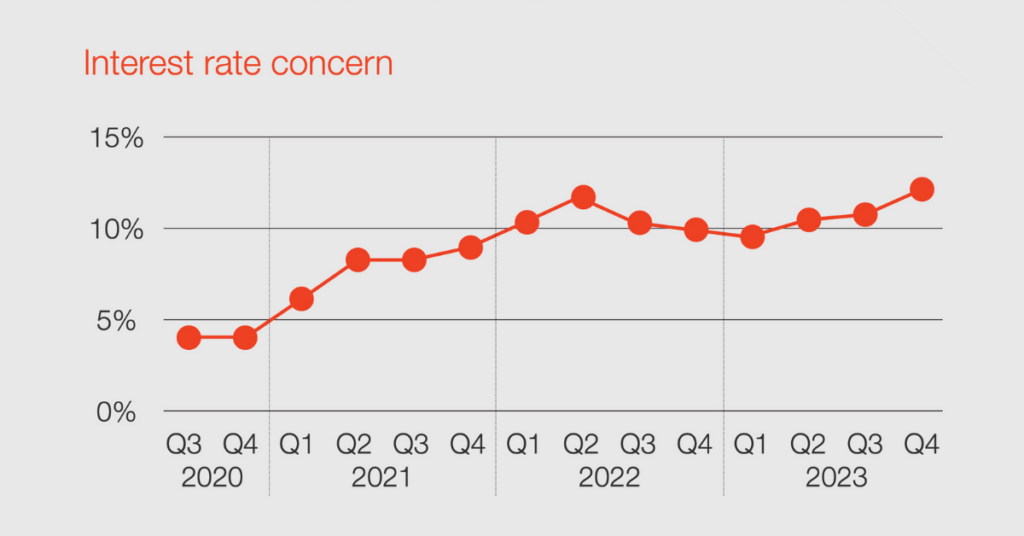

Interest Rates and Market Dynamics

Interest rates remain a significant concern for both buyers and sellers, shaping the property market’s overall sentiment. Although there are predictions of potential interest rate decreases, there is still concern about how rate hikes could affect loan affordability and property prices.

If interest rates were to rise significantly, it might lead to an excess of properties for sale and put downward pressure on prices. This proves the importance of staying vigilant and planning strategically, especially in the changing interest rate environment.

The Q4 2023 report highlights a clear trend of buyer interest outweighing seller intent, with more respondents expressing a desire to buy property in the next 12 months compared to those looking to sell. Despite high interest rates and inflation levels, buyer sentiment remains strong, indicating resilience despite the current financial challenges.

Mortgage Stress and Financial Planning

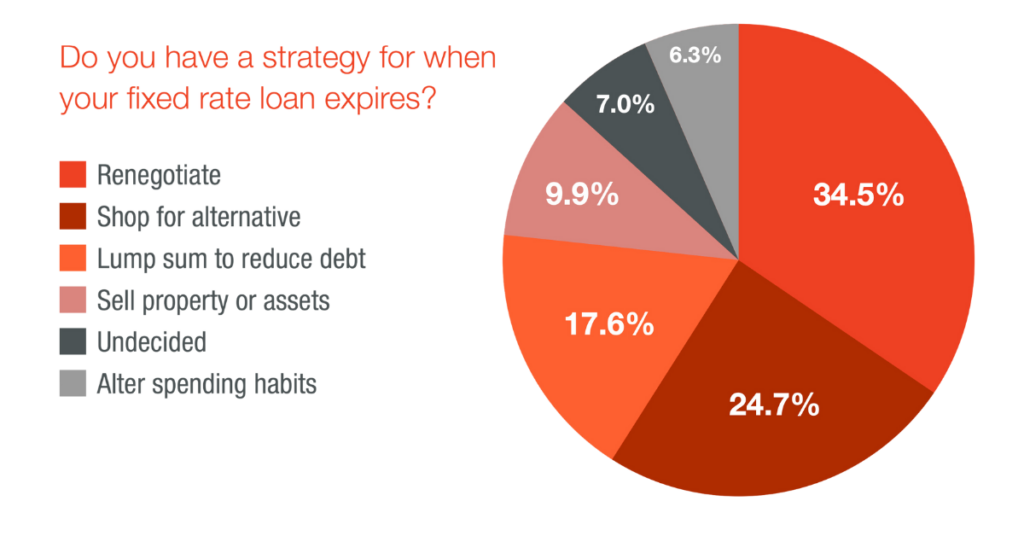

Despite the high interest rates, there are signs that mortgage stress levels are slightly easing, thanks to factors like stabilising rates and high rental yields. Homeowners and investors are using strategies like refinancing to overcome the challenges of the end of low fixed-rate loans.

Record levels of refinancing in recent years, with 60% of survey respondents considering refinancing after transitioning from lower fixed rates to higher variable rates, have significant implications for banks and the economy overall. Although mortgage and rental stress remain factors (more than a third of investors say they are experiencing some), the sentiment in the property market remains positive, largely driven by rising property prices and ongoing supply issues.

Regional vs City Markets

While capital cities continue to outperform regional areas in property price growth, there’s a noticeable shift towards wanting to buy houses, possibly due to their historically stronger capital growth performance and the increasing appeal of buying in the outer suburbs. For instance, Armadale, a less gentrified suburb in Perth, saw a remarkable 50% increase in prices.

Investor Concerns and Market Drivers

Tips for Using Property Sentiment Reports Effectively

Here are some tips to help effectively leverage property sentiment reports.

- Keep on top of the quarterly property sentiment reports and updates to stay informed about market trends and developments

- Use insights from property sentiment reports to diversify investment portfolios and mitigate risks across different property types and locations.

- Take a long-term perspective when interpreting property sentiment reports and making investment decisions, considering both short-term fluctuations and long-term trends in the market.

What’s Your Next Move?

Established in 1997, Australian Property Investor Magazine is one of Australia’s leading property information brands. They are passionate about protecting the interests of their audience of investors, homebuyers and property professionals through best in market property education, information and research. They provide a rich source of breaking news, analysis, and feature articles on all aspects of the property sector.

By understanding how their sentiment reports are compiled, interpreting the key metrics and indicators, and using them effectively in investment decision-making, you can further understand the Australian property market. You can also tap into their Australian property investment knowledge for free by subscribing to their weekly newsletter.

If you would like to get the ball rolling on an investment property, reach out to an investment loan expert here at Atelier Wealth Mortgage Brokers. No matter what stage of the investment process you’re in, we can assist you.