Is Stamp Duty Tax Deductible on an Investment Property?

Blog

Mindset Tips for Success in Property Investment

Blog

Property Investment Q&A: Busting Mortgage Myths & Maximising Borrowing Power

Blog

Property Investment Q&A: Busting Mortgage Myths & Maximising Borrowing Power

Thinking about investing in Australian property? Affordability concerns and navigating the loan process can feel overwhelming. But fear not! This Q&A session with a team of expert brokers – Aaron Christie-David, Bernadette Christie-David, Damien Walker, and Nate Condie – tackles your burning questions and offer practical strategies to help you achieve your property investment goals.

How Can I Save Money To Buy A House?

Blog

Should I buy a house now? The answer is yes.

Blog

How to Start Investing in Property

Blog

How to Start Investing in Property

Property investments can provide stability and predictability making it a great option for beginners. Here's how to start investing in property.

Exploring the Property Market Forecast for 2024

Blog

Best Ways To Build Generational Wealth

Blog

How Proptech Like Auction Snitch Is Changing Real Estate

Blog

How to Add Value to Your Property

Blog

Unpacking the Australian Property Investor Sentiment Report Q4 2023

Blog

The Property Investment Strategy That You Shouldn’t Sleep on

Blog

Investment Property: Types, Financing Options, & How to Buy One

Blog

12 Tips for Buying an Investment Property

Blog

How A Buyer’s Agent Can Help You Secure the Perfect Property

Blog

What is a Strata Inspection Report?

Blog

Cultivating Success Through an Abundance Mindset: Insights from Aaron Christie-David

Blog

Cultivating Success Through an Abundance Mindset: Insights from Aaron Christie-David

Our Founder, Aaron Christie-David, is redefining success in the mortgage broking industry with a focus on cultivating an abundance mindset. Through his recent appearance at the Always Be Connecting podcast produced by Storytellers Australia, Aaron highlights the crucial role of building deep, meaningful relationships in achieving both personal and business success.

Life Beyond Law: Finding Freedom, Fulfilment, and Buying Property - A Mortgage Broker's Story

Blog

The Australian Housing Market: Past Trends and Future Predictions

Blog

The Great Australian Property Market Puzzle

Blog

Cash Rate in Australia Remains at Nine-Year High of 4.35%

Blog

Cash Rate in Australia Remains at Nine-Year High of 4.35%

The RBA holds Australia's official cash rate at 4.35% to start 2023 after sharp hikes last year, serving as the baseline for interest rates. What is the cash rate, how high could it go, and how are variable home loans and savings impacted? This article explains the cash rate in-depth, projections for 2023, effects on consumers and businesses, and how to navigate still-high rates.

What's Fueling the runaway Australian Property Market Train?

Blog

What’s Fueling the runaway Australian Property Market Train?

An in-depth dissection of the key ingredients fueling Australian property market success. From voracious investor appetite to limited land supply and low-interest rates turbocharging mortgages, this analysis investigates the perfect storm of factors sustaining a property's golden run. It also explores potential risks that could derail future growth if left unchecked.

Australia's Housing Shortage Crisis

Blog

Australia’s Housing Shortage Crisis

Housing Shortage in Australia faces intensifying shortages with demand drastically outpacing supply. Learn how taking a systems thinking approach can help key actors across construction, policy and property collaborate on sustainable solutions.

Unlocking The Commercial Property Portfolio Potential

Blog

Unlocking The Commercial Property Portfolio Potential

Learn precisely when adding warehouses, office spaces and other commercial assets unlocks the true capability dormant within your property portfolio by turbocharging equity manufacturing for accelerating wealth building overall. From strong foundations to multiplying returns, discover the carefully timed injections that unlock the commercial property portfolio potential.

2024 Australian Property Market Predictions

Blog

2024 Australian Property Market Predictions

Comprehensive 2024 Australian Property Market Predictions outlook for real estate detailing market forecasts, price predictions by city, factors impacting growth, and advice for positioning in uncertain times.

How Australians Can Save Money by Home Loan Refinancing

Blog

How Australians Can Save Money by Home Loan Refinancing

This in-depth guide covers everything Australians need to know about proper home loan refinancing, and financial planning including setting life goals, budgeting, managing debt & taxes, investing for retirement, insurance, and tips from financial advisors to ensure you optimise money management, reducing debt, and secure your family’s financial future.

Comprehensive Guide to Financial Planning for Australians

Blog

Comprehensive Guide to Financial Planning for Australians

This in-depth guide covers everything Australians need to know about proper financial planning including assessing your finances, setting life goals, budgeting, managing debt & taxes, investing for retirement, insurance, estate planning, and tips from financial advisors to ensure you optimize money management, reduce debt, and secure your family’s financial future.

How Leading Aussie Investors Progress Ambitions Without Forfeiting Health and Happiness

Blog

How Leading Aussie Investors Progress Ambitions Without Forfeiting Health and Happiness

Pursuing investment success should never undermine personal health or purpose. Yet with numerous demands on time and energy, maintaining perspective on core motivations is challenging. This guide shares advice from Australia’s top-performing investors on how they balance ambitious investing and business goals with deeper needs for fulfilment and well-being. Learn how they set purpose-driven goals tied to passion projects versus money alone, stay responsive by reshaping plans around life’s ups and downs, and prioritize self-care alongside progress. With insight on processing emotions constructively, leveraging strengths sustainably, and retaining focus on what matters most, top-up investment outcomes without losing your way.

Why Every First Home Buyer Needs a Broker Like Atelier Wealth

Blog

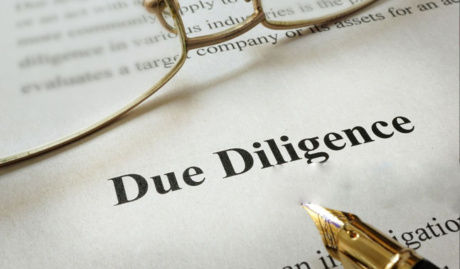

How to Conduct Thorough Due Diligence When Buying Investment Property in Australia

Blog

How to Conduct Thorough Due Diligence When Buying Investment Property in Australia

Conducting proper due diligence is crucial for Australian property investors. This article explores what due diligence involves, why it matters, how to build your due diligence team, and how to use it to protect your investment goals when buying property. Learn why thorough research is essential to make informed decisions and minimise risk.

Unlock Your Full Borrowing Potential for Optimal Property Investing

Blog

A Comprehensive Guide on First Home Buying

Blog

A Comprehensive Guide on First Home Buying

Everything you need to know about buying your first home in Australia. This in-depth guide covers saving for a deposit, getting loan pre-approval, using grants/schemes, finding the right property and suburb, bidding at auction, and more.

A Complete Guide to ‘Rentvesting’ in Australia

Blog

A Complete Guide to ‘Rentvesting’ in Australia

Rentvesting is becoming increasingly popular in Australia. Learn what rentvesting is, why Australians are doing it, and find tips on the best places and strategies to rentvest across the country.

Cash Rate on the Move Again: RBA Increases Official Cash Rate to 4.35%

Blog

The Top 7 Secrets of Successful Property Investors in Australia

Blog

The Top 7 Secrets of Successful Property Investors in Australia

Artificial intelligence is disrupting real estate, providing data-driven insights for smarter property investing. This article explores how AI can analyse markets, assess deals, predict prices, and automate tasks to find profitable investments in Australia.

Can AI Transform Property Investment in Australia?

Blog

Can AI Transform Property Investment in Australia?

Artificial intelligence is disrupting real estate, providing data-driven insights for smarter property investing. This article explores how AI can analyse markets, assess deals, predict prices, and automate tasks to find profitable investments in Australia.

Creating Climate-Resilient Homes: Should You Build Sustainably?

Blog

Creating Climate-Resilient Homes: Should You Build Sustainably?

With climate change intensifying natural disasters, sustainable and resilient home design matters more than ever. This article explores how to create climate-adapted shelters that can withstand floods, bushfires, droughts, and heatwaves through passive solar, renewable energy, durable materials, and smart construction.

The Power of Positive Cashflow for Property Investing Success

Blog

The Power of Positive Cashflow for Property Investing Success

Achieving positive cash flow is key to building a strong investment property portfolio in Australia. This comprehensive guide covers how to maximise rents, optimise taxes, use equity, and leverage depreciation to ensure your properties generate more income than expenses each month.

The Complete Guide to Unlocking Property Investment Through SMSF

Blog

The Complete Guide to Unlocking Property Investment Through SMSF

Buying property with a self-managed super fund unlocks tax benefits and wealth-building potential. This comprehensive guide covers SMSF property rules, loan types, deposit tips, location factors, due diligence, and more. Learn how to establish and leverage your SMSF for strategic property investments.

Investing in Commercial Property: A Beginner’s Guide

Blog

Timing the Property Market vs Long-Term Investing: How to Build Real Estate Wealth

Blog

Plan Your Legacy: Why A Will and Estate Plan Matter

Blog

Plan Your Legacy: Why A Will and Estate Plan Matter

Think estate planning doesn't matter until you're older? Think again. An updated will and comprehensive estate plan can prevent major complications regardless of age or assets. This article covers what estate planning entails, why it's essential to do ASAP, and how it protects your family's interests when you pass away. Gain insight into how effective plans distribute your assets, assign guardianship of children, establish trusts, minimise taxes, and avoid disputes. Find out why you need to appoint executors and structure your legacy properly with professional guidance. Don't jeopardize your loved ones' future.

Investing in Property & Alternative Investments For Your Children

Blog

Investing in Property & Alternative Investments For Your Children

Want to secure your children's financial future but unsure where to start investing in Australia? This guide explores the best property and alternative investment options for building long-term wealth for your kids. Learn smart strategies for investing in real estate, shares, high-interest savings, and gold. Discover how to buy investment properties with positive cash flow, add your child to the title, invest in ETFs and blue chips, maximize interest savings accounts, and leverage the power of compound growth. With tips for getting started early, investing regularly, and involving children in financial decisions, you can set your kids up for financial success through savvy investing.

Overcoming Your Fears To Invest In Property in Australia

Blog

Overcoming Your Fears To Invest In Property in Australia

Feeling afraid to start investing in property? Anxiety about debt, risk, and failure often holds aspiring investors back. This blog provides practical tips to overcome Australia's most common property investment fears. Learn how to move past analysis paralysis, leverage mentors and education, start small to limit risk, and take imperfect action despite fear. Gain the knowledge and mindset to confidently begin your Australian real estate wealth-building journey. Discover how to push past fear and start investing in property even as a beginner.

A Guide To Real Estate Investing For Beginners

Blog

Behind the Real Estate Curtain with Penny Vandenhurk

Blog

Behind the Real Estate Curtain with Penny Vandenhurk

Discover expert property pricing tips from Penny Vandenhurk, Director and Buyer's Agent at Purchase with Penny. Unlock the secrets of real estate transactions and make confident property choices with insider insights. Tune in to the Australian Property Investment Podcast now!

The Ultimate Guide to Guarantor Loans in Australia

Blog

The Ultimate Guide to Guarantor Loans in Australia

Explore the options, benefits, and potential pitfalls of guarantor loans while learning how to make informed decisions about your financial future. From securing your dream home to improving your creditworthiness, this guide has you covered. Don't miss out on this essential resource for achieving your financial goals in 2023.

Australia's Rental Market in Focus: Key Shifts and Insights from Q3 2023

Blog

Understanding the Shift: Construction Cost Trends in 2023

Blog

Understanding the Shift: Construction Cost Trends in 2023

Explore the latest trends in construction cost growth and what they mean for the building sector. Discover insights into material and labour cost fluctuations and how they impact the industry. Get state-wise breakdowns and expert analysis to stay informed about the changing dynamics.

The Mind Behind the Money: Decoding Behavioural Secrets for Property Investment Mastery

Blog

Unveiling the Secrets to Purchasing Property through Your SMSF: A Comprehensive Guide on the Do's and Don'ts

Blog

Key Strategies to Unearth the Untapped Potential of Your Land in Australia

Blog

Key Strategies to Unearth the Untapped Potential of Your Land in Australia

Explore strategic insights into elevating the worth of your Australian landholdings. From understanding local zoning laws and optimising land use to smart investment in infrastructure and community engagement, our guide unfolds the path to harmoniously merge profitability with sustainability in land development. Unlock the potential of your property today with our expert tips and strategies.

Your Ultimate Guide When Investing in a Brand New Property

Blog

Your Ultimate Guide When Investing in a Brand New Property

Unlock the secrets of successful real estate with our ultimate guide on what to look for when investing in a brand new property. Dive into a world of strategic evaluation, understanding strata reports, navigating under quoting, and mastering negotiation tactics to ensure your next property investment is astute, secure, and prosperous. Your journey to becoming a savvy property investor starts here!

Unleashing the Power of Atomic Habits for Monumental Life Changes

Blog

Unleashing the Power of Atomic Habits for Monumental Life Changes

Dive into the transformative power of Atomic Habits and discover how minute, consistent behavioral shifts can compound into monumental life changes. Explore a guide on forming, sustaining, and evolving habits that pave the path towards your personal and professional aspirations.Engaging with this practical guide to atomic habits, readers will unearth the secrets to crafting a life woven with intentional, empowering habits, propelling them towards their aspirations and a robust, enriched life.

How to Dodge Exhausting Your Borrowing Capacity

Blog

How to Dodge Exhausting Your Borrowing Capacity

Unlock the secrets to everlasting financial flexibility with our ultimate guide on avoiding running out of borrowing capacity. Explore proven strategies focused on safeguarding your credit score, mastering debt management, and making wise investment choices to ensure you navigate every financial season with stability and opportunity. Elevate your financial journey with tips that preserve and amplify your borrowing potential, making your dreams and goals ever accessible.

Stand Out in the Spring Market: Selling Your Property the Right Way

Blog

Stand Out in the Spring Market: Selling Your Property the Right Way

Discover the ultimate guide to selling your property successfully during the spring season. Our comprehensive article provides expert tips on preparation, presentation, promotion, and pricing to help your property stand out in the competitive spring real estate market. Whether you're selling your residence or an investment property, this resource will guide you through the essential steps to maximise your property's appeal and achieve the best results. Take advantage of this invaluable advice for a seamless and profitable spring property sale.

Unlocking the Secrets to Young Investor Success in Property Investment

Blog

Unlocking the Secrets to Young Investor Success in Property Investment

Building on insights from last week's guest Eddie Dilleen on the Australian Property Investment Podcast, this article offers a comprehensive guide for young investors. Learn key strategies, the importance of relationship-building with real estate agents, and essential negotiation skills to succeed in the property market. Stop waiting for the 'perfect moment'—read on to kick start your investment journey.

Essential Qualities to Look for in a Sydney-Based Mortgage Broker

Blog

Essential Qualities to Look for in a Sydney-Based Mortgage Broker

Discover how to find the perfect mortgage broker in Sydney, Australia. This comprehensive guide provides essential criteria to consider and introduces Atelier Wealth as your top choice. With expertise, a broad lender network, and stellar reviews, Atelier Wealth simplifies your mortgage journey.

The Rising Tide of Distressed Property Sales in Sydney's Outer Suburbs

Blog

Beyond the Hammer: The Hidden Truth Behind Auction Clearance Rates

Blog

Beyond the Hammer: The Hidden Truth Behind Auction Clearance Rates

Dive into the unexplored realm of real estate auction clearance rates, where the true influencer isn't just the market dynamics. Discover how 'Operator Error' plays a pivotal role in determining the success of property auctions and why choosing an adept agent can make all the difference. Learn about key terms like 'Uncollectibles' and 'Preliminary Results' to stay ahead in the real estate game.

Australia's Housing Market 2023: Resilience and Growth Trends

Blog

The Integral Relationship Between Health and Fitness

Blog

The Integral Relationship Between Health and Fitness

Dive into the intrinsic connection between health and fitness. Explore the benefits of a fit lifestyle, understand the synergy between the two, and discover actionable tips to weave them into your daily routine. Prioritise well-being today!

Empowering Investors Through Mentorship in Property Success

Blog

Ready to Apply for a Home Loan? How Does AMP Bank's One Touch Formal Process Work?

Blog

The Key to Property Portfolio Growth

Blog

The Key to Property Portfolio Growth

Explore the transformative power of equity in scaling your property portfolio. This comprehensive guide delves into the relationship between equity and growth, the significance of Precision, Performance, Profits, leveraging equity for renovations, capital growth vs. cash flow dilemma, and the emergence of data-driven decision-making. Tune into Episode 104 of the Australian Property Investment Podcast and unleash equity's potential to shape your financial destiny.

The Ultimate Guide for Traveling Overseas

Blog

The Ultimate Guide for Traveling Overseas

Get ready to go on an overseas adventure with the help of our comprehensive overseas travel guide. Learn in-depth advice for planning a trip of a lifetime anywhere in the world, from packing light to honouring local customs.

The Key to Thriving as a Real Estate Investor

Blog

The Key to Thriving as a Real Estate Investor

Discover how confidence serves as the driving force for real estate investors, shaping their journey to success. Unravel the secrets of self-assurance, embrace risk with composure, and learn to turn setbacks into stepping stones. Empower yourself with assertiveness and inspire others as you cultivate the essential trait of confidence in the dynamic world of real estate investing.

Is it Possible to Achieve Work-Life Balance in the 21st Century?

Blog

Is it Possible to Achieve Work-Life Balance in the 21st Century?

Dive into our comprehensive guide to strike the right chord between work and personal life. Understand what work-life balance truly means, the risks of imbalance, and practical steps you can take towards achieving a fulfilling, balanced life in the modern world.

Unlocking Property Wealth: First-Time Home Investors’ Guide to Equity and Rentvesting

Blog

The Power of Holistic Wellness for Physical and Emotional Health

Blog

Unlocking the Inner West: A Comprehensive Buying Guide for Homebuyers

Blog

Unlocking the Inner West: A Comprehensive Buying Guide for Homebuyers

Discover expert tips and strategies in our comprehensive Inner West buying guide. Navigate the competitive real estate market, define your priorities, set a realistic budget, and leverage the expertise of a buyer's agent to secure your dream home in Sydney's vibrant Inner West region.

Thriving in the Professional Industry: Essential Tips for Success

Blog

Celebrating 100 Episodes: Reflecting on the Australian Property Investment Podcast's Journey

Blog

The Ultimate Guide to Building a Profitable Commercial Property Portfolio

Blog

Examining the Impact of Rate Hikes as Cash Rate Stays at 4.10%

Blog

Examining the Impact of Rate Hikes as Cash Rate Stays at 4.10%

The RBA's decision to hold the cash rate at 4.10% offers relief to Australian borrowers while the bank assesses the economy's status. Future rate changes depend on domestic and global economic data, with a commitment to achieving the inflation target.

Expert Tips on How to Secure Your Dream Home - Friend or Foe, What's Your Real Estate Agent's Role?

Blog

Expert Tips on How to Secure Your Dream Home – Friend or Foe, What’s Your Real Estate Agent’s Role?

Navigating the real estate market can often feel like stepping into a labyrinth. Luckily, we have industry insiders like Scott Aggett, Founder and Expert Property Negotiator of Hello Haus, ready to shine a light on the twists and turns of the property-buying journey. As a former real estate agent, Scott's unique perspective demystifies the process, helping aspiring homeowners avoid common pitfalls and make confident property choices.

Examining the Changing Patterns of Homeownership and Tenure

Blog

Examining the Changing Patterns of Homeownership and Tenure

Housing is more than just a roof over our heads. It's a cornerstone for security, stability, and well-being, especially in a diverse and dynamic country like Australia. Homeownership, in particular, holds an esteemed place in the aspirations of Australians, providing not only a sense of housing tenure security but also opening the door to a host of long-term social and economic benefits (AIHW 2022). However, the conversation around homeownership and housing affordability has sparked rigorous debate in public forums.

Exploring Self-Managed Super Funds: Insightful Lessons in Building Wealth through Property

Blog

Exploring Self-Managed Super Funds: Insightful Lessons in Building Wealth through Property

In podcast episode 97, we unravel the truth behind buying, lending, and self-managed super funds. Ever dreamt of securing your financial future through real estate? Get ready to turn that dream into reality. We break down complex topics and reveal the secrets of successful wealth generation through property.In a world where financial independence is a sought-after dream, Raymond Hempstead, a seasoned financial expert, shares his wisdom and insights on self-managed super funds (SMSFs), aiming to debunk the prevailing misconceptions around this wealth-building strategy. With years of experience in the financial sector, Hempstead's unique approach to investment and lending strategies provides a fresh perspective on the opportunities and potential pitfalls of SMSFs.

Twin Shadows of the Workplace: Burnout and Impostor Syndrome Plague 45% of Workers, Asana Study Reveals

Blog

Twin Shadows of the Workplace: Burnout and Impostor Syndrome Plague 45% of Workers, Asana Study Reveals

In a climate where working from home, flexible hours, and task management software are becoming commonplace; employees are experiencing less stress. However, a recent study by Asana, a leading work management platform, paints a starkly different picture. A shocking 45% of workers grapple with the double whammy of burnout and impostor syndrome, two persistent mental health issues that can significantly impact productivity and overall well-being.

The Journey from City Bustle to Tranquil Blue Mountains

Blog

The Journey from City Bustle to Tranquil Blue Mountains

In podcast episode 96, we introduce you to a remarkable woman, Faithe Skinner, who successfully traded the hustle and bustle of city life for the serene landscapes of the Blue Mountains while amassing a portfolio of five properties.

The Power of Belief: How Your Mindset Affects Mental Health and Well-being

Blog

The Power of Belief: How Your Mindset Affects Mental Health and Well-being

A groundbreaking study has revealed the profound impact of our beliefs on our mental health. Simply believing that you have the power to improve your mental health is intrinsically linked with higher overall well-being. This connection highlights the importance of mindset and self-efficacy in our journey towards mental wellness.

Event Recap: Navigating the 7% HECS Debt Indexation Rate Increase - Your Roadmap to a Smarter Educational Investment

Blog

Lenders Mortgage Insurance (LMI): A Foe or A Friend to Property Investors?

Blog

The Borrower's Dilemma: Exploring Patterns and Trends in Lending Behaviours

Blog

The Borrower’s Dilemma: Exploring Patterns and Trends in Lending Behaviours

In today's financial landscape, lending behaviours are crucial in shaping individuals' financial well-being and economic growth. Whether you borrow funds for personal or business purposes, understanding lending behaviours is essential to make informed decisions and effectively manage your financial obligations. This comprehensive guide will delve into the various aspects of lending behaviours, providing valuable insights and practical tips for borrowers and lenders alike.

Navigating the Benefits of First-Time Home Buying & Budgeting Insights

Blog

Navigating the Benefits of First-Time Home Buying & Budgeting Insights

In podcast episode 93, we discussed an intriguing topic: First Home Buyer Benefits and What’s the Budget In It. We had the pleasure of having an expert guest, Damien Walker, who has been instrumental in helping numerous first-time home buyers and investors navigate the complexities of the real estate market.

Getting Ahead of the Fixed-Rate Cliff: A Guide to Surviving and Thriving

Blog

More home buyers set to benefit from low deposit, no LMI schemes

Blog

More home buyers set to benefit from low deposit, no LMI schemes

More Australians (and permanent residents!) will soon be eligible for a leg up into the property market under an expanded Home Guarantee Scheme. Today we’ll run you through all the upcoming changes to the low deposit, no lenders mortgage insurance schemes.

Homeowners brace as RBA raises cash rate to 3.85%

Blog

Homeowners brace as RBA raises cash rate to 3.85%

The Reserve Bank of Australia (RBA) has increased the official cash rate for the 11th time in the past year, taking it to 3.85%. Have we finally reached the peak of this cycle? And how much will this latest rate hike increase your monthly repayments?

Tips to help stay on top amidst the rate hike cycle

Blog

Property listings and prices are bouncing back

Blog

What is the fixed-rate cliff and how can refinancing help?

Blog

Mortgage holders granted a reprieve as RBA puts interest rates on hold

Blog

Money habits that may raise lenders’ eyebrows

Blog

Time to jump in? First home buyer deposit saving times plunge

Blog

Got an eagle eye on house prices? Rate rises are only part of the story

Blog

Homeowners feel the pinch as RBA lifts cash rate to 3.60%

Blog

The latest twist in the tale of national property prices: explained

Blog

How to prepare for a fixed-rate mortgage cliff

Blog

How to prepare for a fixed-rate mortgage cliff

Do you have a fixed-rate mortgage contract that’s coming to an end soon? It can be a stressful time, particularly with rate rise news dominating the headlines. So today we’ve got some tips for a smooth transition.

RBA hikes the cash rate for the ninth time in a row, to 3.35%

Blog

Considering refinancing your mortgage? Here are some questions to ask

Blog

Can a job switch affect your mortgage application?

Blog

Can a job switch affect your mortgage application?

Changing jobs may offer more perks - higher income, greater fulfilment, and the opportunity for growth are often things people look for in a new gig. But could it also impact your mortgage application?

Planning a reno in 2023? Here are 4 tips for smooth sailing

Blog

Get a financial head start on the school year

Blog

Get a financial head start on the school year

Finding the time to delve into your finances can be a struggle. But the school holidays can offer the perfect time, especially for teachers. Get cracking on your financial to-do list these holidays by looking into refinancing your mortgage.

What you should know about buying a tenanted investment property

Blog

4 New Year’s resolutions for financial fitness

Blog

4 New Year’s resolutions for financial fitness

As the sun rises on January 1, many Australians will be getting started on their new year’s pacts. The gym will be full of determined resolution keepers; the pavement pounded by brand-new sneakers. But what about shaping up your finances?

Seasons greetings! Here’s to a happy and prosperous 2023

Blog

First home buyer numbers have halved: is it time to swoop in?

Blog

Are we there yet? RBA hikes cash rate for eighth straight month to 3.10%

Blog

Where there’s a will (and genuine savings), there's a way

Blog

Your new phone or your home loan? What would you research more?

Blog

Your new phone or your home loan? What would you research more?

What’s more important: your new phone or your next home loan? Well, we were stunned to see a recent survey that showed Australians put more effort into researching phone plans than they did their home loan. Here’s how we can help you get the balance right.

5 surprising reasons for home loan heartbreak

5 surprising reasons for home loan heartbreak

Whether it’s your love life or your home loan application, no one likes getting rejected. There are many reasons why it could happen, and some can come as a big shock. So today we’ve outlined five surprising reasons to help you avoid home loan heartbreak.

Buying could be cheaper than renting for a third of properties

Blog

Buying could be cheaper than renting for a third of properties

For many Australians, rate hikes and inflation have made the dream of property ownership feel ever more distant. But a recent analysis shows that meeting mortgage repayments could actually be cheaper than renting for more than a third of Australian properties.

Hold your horses: RBA hikes cash rate again to 2.85%

Blog

Hold your horses: RBA hikes cash rate again to 2.85%

Whoa, Nelly! The Reserve Bank of Australia (RBA) has lifted the official cash rate again, this time by another 25 basis points to 2.85%. How much will this rate rise increase your monthly mortgage repayments, and when are the hikes expected to stop?

With property prices dropping, is now the time to refinance?

Blog

Is now a good time to buy an investment property?

Blog

Is now a good time to buy an investment property?

You’ve bought a home. And now you might be considering adding an investment property to your portfolio. But have recent interest rate hikes cooled your heels? We’ve outlined reasons why now may still be a good time to buy.

Nurses and midwives now eligible for LMI waiver

Blog

Nurses and midwives now eligible for LMI waiver

Nurses, midwives and other important healthcare professionals can now qualify for a lenders mortgage insurance (LMI) waiver policy. Here’s how it could save them thousands and fast-track their journey into home ownership.

RBA lifts cash rate for the sixth month in a row to 2.60%

Blog

How to escape renting and get into the property market

Blog

How long does it take for an interest rate rise to kick in?

Blog

Is now a good time to buy?

Is now a good time to buy?

Recent back-to-back interest rate hikes have led to a cooling of the property market, and with more rate rises predicted, you may feel like pumping the brakes on purchasing. But could the current climate offer opportunities?

RBA hikes the cash rate for fifth straight month to 2.35%

Blog

What happens when you roll off your fixed-rate mortgage?

Blog

Property prices are predicted to dip: 5 ways you can prepare to buy

Blog

Could an eco reno boost your property’s value?

Blog

Could an eco reno boost your property’s value?

You’ve probably heard that interest rates are on the rise and national property prices are on the way back down. Here’s how you can kill two birds with one stone: by refinancing to unlock equity and giving your home an energy-efficient makeover at the same time.

Why you might want to refinance sooner rather than later

Blog

Interest rates to keep climbing as RBA hikes cash rate to 1.85%

Blog

Keep calm and carry on: 5 ways you can absorb interest rate rises

Blog

Renovate or invest? How 7-in-10 Aussies are using their equity

Single and under 30? You’re a great fit for the 5% deposit scheme

Blog

The tax on luxury cars just got a little cheaper

Blog

The tax on luxury cars just got a little cheaper

Got your eye on a luxury car that’ll make your mates jealous? Or perhaps something that’s a little more fuel-efficient and environmentally friendly? Today we’ll run you through a new tax change that could help you buy something a little more la-de-da.

RBA lifts cash rate for the third month in a row to 1.35%

Blog

RBA lifts cash rate for the third month in a row to 1.35%

The Reserve Bank of Australia (RBA) has increased the official cash rate by another 50 basis points to 1.35% amid continuing inflation pressures. How much will this third consecutive hike increase your monthly mortgage repayments?

Financial hardship arrangement reporting is about to change

Blog

Financial hardship arrangement reporting is about to change

With interest rates on the way back up, there’s no doubt some households around the country are starting to do it a bit tough. Coincidentally, some big changes kick in on July 1 when it comes to recording financial hardship arrangements.

Want a first home buyer scheme spot? Here’s how to get the inside lane

Blog

No more Mr Nice Guy: the ATO wants its money

Blog

No more Mr Nice Guy: the ATO wants its money

Tax time is just around the corner and the ATO has sent out a warning to businesses around the country that owe it money: the COVID-19 moratorium on debt collection has come to an end. Rest assured though, you’ve got some options.

Refinancing numbers are surging across the country, here’s why

Blog

RBA increases cash rate for second consecutive month, to 0.85%

Blog

Banks tighten lending, reducing the maximum you can borrow

Blog

Bulk of SMEs preparing for growth over next 12 months: research

Blog

ATO hit list: rental property income and capital gains

Blog

The two major parties’ first home buyer policies explained

Blog

EOFY alert! Financial year-end is fast approaching

Blog

Ready for lift-off: how to prepare a buffer for more rate rises

Blog

Ready for lift-off: how to prepare a buffer for more rate rises

Rate rises are a bit like taking off in a plane. Sure, it's a bit nervy, but so long as you’ve run through your pre-flight check, have a well-serviced aircraft, built-in some contingencies (a buffer!), and have a handy co-pilot (us!), you should reach your destination no worries.

RBA increases cash rate to 0.35% amid high inflation concerns

Blog

SMEs invest in machinery, IT and energy-efficient assets for growth

Blog

Brace yourselves: a May rate hike might be coming next week

Blog

Brace yourselves: a May rate hike might be coming next week

The chances of the Reserve Bank of Australia (RBA) lifting the official cash rate on Tuesday just increased dramatically after figures showed the cost of living jumped 5.1% over the past year - the highest annual increase in more than 20 years.

Attention first home buyers! Price caps increase for 5% deposit scheme

Blog

How to avoid becoming a victim of underquoting

Blog

How to avoid becoming a victim of underquoting

It’s the hope that kills you. Just ask Carlton fans, NSW Blues supporters, Wallabies sufferers, and hopeful homebuyers who have fallen victim to underquoting. Obviously, you can’t change your footy team, but you can follow these tips to avoid the sketchy real estate practice.

What the!? Tesla came third on the new vehicles sold list?

Blog

How to save a first home deposit in just over a year

Blog

Budget winners: first home buyers, regional buyers, single parents

Blog

How much have car prices gone up since the pandemic began?

Blog

16 ways the government should tackle housing affordability: report

Blog

16 ways the government should tackle housing affordability: report

Think property prices have gone a little bonkers? You’re not the only one. Which is why a report with 16 recommendations to tackle housing affordability has just been plonked on pollies’ desks in Canberra. Today we’ll run through them for you (succinctly, we promise).

What’s your debt-to-income ratio? And why do lenders care about it?

Blog

Flood victims can defer loan repayments for up to 3 months

Blog, News

Flood victims can defer loan repayments for up to 3 months

Home and business owners impacted by the floods in New South Wales and Queensland can apply to their lender for a three-month loan deferral or reduced payment arrangement. Here’s how to apply if you or someone you know has been impacted.

Thought about buying an EV? Interest rates for them are dropping

Blog

Thought about buying an EV? Interest rates for them are dropping

It wasn’t long ago that the idea of buying an electric vehicle (EV) seemed like a bit of futuristic science-fiction. But with interest rates on EV loans recently dropping to under 3%, going electric is now more in the realms of an everyday, mundane, household budget decision.

Which two capital cities might have just hit their property price peak?

Blog

Fixed rates on the rise, as CommBank tips a June cash rate hike

Blog

Fixed rates on the rise, as CommBank tips a June cash rate hike

Hold onto your hats, things are about to get a little bumpy. Economists from Australia’s biggest bank are predicting the Reserve Bank will raise the official cash rate as early as June - and we’re already seeing fixed interest rates increase significantly.

Where are tradies most in demand at the moment?

Blog

Where are tradies most in demand at the moment?

Keen to tackle a renovation project in 2022? You might have noticed that tradies are hard to pin down at the moment. So if you live in one of the suburbs in this week’s article, you might want to get the ball rolling sooner rather than later…

Why are houses becoming so much more expensive to build?

Blog

Flexibility emerges as a key priority for small business loans

Blog, Small Business Loans

One in five young adults are saving to start their own business

Blog

Your suburb’s 2021 property report card is in

Blog

Your suburb’s 2021 property report card is in

With all the talk of record-breaking property growth throughout 2021, do you know how exactly your suburb and property type performed? Today we’ll show you how to find out in just a few clicks.

Borrowing soars: average loan up almost $100,000 in 12 months

Blog

What was Australia’s top-selling vehicle in 2021?

Blog

Homeowners nearly four years ahead on their mortgage repayments

Blog

Three (financial) New Year’s resolution ideas

Blog

Three (financial) New Year’s resolution ideas

Cut calories, increase your steps, abstain from alcohol: each year we set ourselves some pretty lofty New Year’s resolutions, most of which are doomed to fail. So why not add a nice straightforward financial goal to the list this year?

Season’s greetings! Here’s to a prosperous 2022!

Blog

Season’s greetings! Here’s to a prosperous 2022!

To all our terrific clients: thank you for your ongoing support and for being such wonderful, loyal clients. We hope you’re shifting into holiday mode and getting ready to relax and unwind (or looking forward to a few public holidays at least!).

Up to 4,600 first home buyer guarantees back up for grabs

Blog

How many SMEs find it difficult to repay business loans?

Blog

How many SMEs find it difficult to repay business loans?

Ever thought about taking out a loan for your business but hesitated because you were worried about meeting your repayments? Don’t worry, it’s a common concern. But some promising data has just come out that might help you put those fears aside.

Don’t drown in Buy Now Pay Later debt this Christmas

Blog

Don’t drown in Buy Now Pay Later debt this Christmas

Christmas is fast approaching and there’s a good chance you’ve started turning your attention to gifts for family and friends. But be careful this silly season: more than half of Buy Now Pay Later customers are struggling to pay day-to-day living expenses.

FOMO factor: more Aussies looking to buy with mates or siblings

Blog

Are your cashflow needs in order ahead of the summer trading season?

Blog

How well has your salary kept up with house prices?

Blog

Think property prices will dip when rates rise? Don’t bet the house on it

Blog

How to protect your business and your customers from scams

Blog

How to protect your business and your customers from scams

When you pay a supplier or service provider, are you certain you’re paying the right account? You’ve got to be super careful these days, as scammers are compromising inboxes and requesting payments to a new account. Here’s how to protect your business and its customers.

Open banking is ramping up, so how are lenders using your data?

Blog

Wheels in motion: RBA paves the way for early cash rate rise

Blog

Netflix and too chill: house hunters cutting corners on inspections

Blog

Are you relying on a personal credit card for business expenses?

Blog

Are you relying on a personal credit card for business expenses?

We’ve all been guilty of the odd credit card mix-up from time to time - it happens! But if you’re consistently relying on a personal credit card to pay your business expenses - like 4-in-10 SME owners - then it’s probably time to explore other funding options.

Seismic shift: two major banks hike fixed interest rates

Blog

Seismic shift: two major banks hike fixed interest rates

Are the days of ultra-low fixed interest rates over? It’s looking increasingly so, with two major banks increasing their fixed rates this week. So if you’ve been thinking about fixing your mortgage lately, it could be time to consider doing so.

How 1-in-10 first home buyers cracked the market 4 years sooner

Blog

SME lending options are on the rise, but how do you access them?

Blog

Bar raised for borrowers: tougher home loan serviceability tests

Blog

Is a home loan lending crackdown on the horizon?

Blog

Is a home loan lending crackdown on the horizon?

The federal treasurer has given the strongest indication yet that a home loan crackdown is coming, stating that “carefully targeted and timely adjustments” may be necessary to avoid troubled waters. So what could a potential lending crackdown look like?

Only half of SMEs have recently been able to secure full funding: report

Blog

Top 5 property investor trends for 2021-22

Blog

Top 5 property investor trends for 2021-22

With house prices going gangbusters in the first half of 2021, is it still a good time to buy property? The majority of investors think so, according to the latest annual survey. And investors have their sights set on one city in particular.

Are you too loyal for your own good? The banks think so

Blog

Refinancing figures are on a record-breaking run: here’s why

Blog

Are they really OK? Here’s how to check in with them today

Blog

Are they really OK? Here’s how to check in with them today

Do you know how the people in your world are really doing right now? Chances are you know someone who’s doing it tough, but silently pressing on. As always, we’re here to support you, and for R U OK? Day we’re sharing ways you can help others.

Nine in 10 FHBs trust brokers to help them buy their first property

Blog

SME Recovery Loan Scheme revamped to help more businesses

Blog

SME Recovery Loan Scheme revamped to help more businesses

More small and medium-sized businesses struggling to stay afloat due to the economic impacts of COVID will have access to cheaper funding after the federal government expanded the eligibility criteria for the SME Recovery Loan Scheme.

How to ease financial pressure through debt consolidation

Blog

COVID hardship and grant options that could help you

Blog

New super laws: a timely reminder to check your life insurance policy

Blog

House price growth hits 17-year high, but is it slowing down?

Blog

Cash flow tips for businesses thriving and surviving the pandemic

Blog

Buy Now Pay Later users put on notice by credit agency

Blog

What’s the best day to auction your house?

Blog

What’s the best day to auction your house?

Drive or walk around your local suburb mid-morning on a Saturday and chances are you’ll pass a few freshly banged up ‘Auction’ signs. But is Saturday actually the best day to auction your home? New data suggests perhaps not.

Need help paying your insurance and workers comp premiums this year?

Blog

Green thumbs beware: one-third of veggie gardens contaminated with lead

Blog

How much extra will your mortgage cost when interest rates rise?

Blog

How much extra will your mortgage cost when interest rates rise?

After 18 straight RBA cash rate cuts it can be easy to dismiss the notion that interest rates might rise again. But if the cash rate returned to mid-2019 levels, how much extra would an average new mortgage holder expect to pay each month? Let’s take a look.

It’s on! First home loan deposit schemes open for applications

Blog

EOFY alert! Financial year end just days away

Blog

Property price caps increased for first home loan deposit scheme

Blog

Size matters: how to get more bang for your buck on property sizes

Blog

Aussie businesses load up on light commercial vehicles

Blog

33 suburbs where buyers still have the upper hand over sellers

Blog

33 suburbs where buyers still have the upper hand over sellers

Most of Australia may be a seller’s market right now, but there are still a few dozen suburbs around the country where there’s more housing stock available than in previous years. Today we’ll check out which 33 suburbs are still offering plenty of options for buyers.

4 in 5 hopeful buyers don’t understand key financial concepts

Blog

4 in 5 hopeful buyers don’t understand key financial concepts

While most Australians dream of owning their own home, the majority of hopeful homeowners admit they don’t fully understand how home loans or mortgage rates work. That’s why we make it our mission to enlighten you during your home buying journey.

Pedal to the metal: EOFY is officially bearing down on us

Blog

“Tide turning on interest rates”: CBA hikes fixed rates

Blog

“Tide turning on interest rates”: CBA hikes fixed rates

Australia’s biggest bank has hiked its three-year fixed rate for owner-occupiers in a further sign that “the tide is turning on interest rates”. So if you’ve been thinking about fixing your interest rate, it could be high time to do so.

Want to switch home loans? Here are ASIC’s top tips for refinancing

Blog, News

SMEs to get full asset write-off extension and fairer go with ATO

Blog

SMEs to get full asset write-off extension and fairer go with ATO

Small businesses in dispute with the ATO over their tax debt will get “a fairer go” under new rules proposed in the federal budget. Meanwhile, one-year extensions have been granted for the full asset write-off and loss carry-back schemes. Let’s break it all down.

Single parents and first home buyers get big budget boost

Blog

Is it cheaper to buy or rent your next home? You might be surprised

Blog

Has the housing market’s latest record-breaking run peaked?

Blog

Business demand for equipment has hit record numbers

Blog

HomeBuilder extension gives applicants extra 12 months to start building

Blog

How long do you have to snap up a property in the current market?

Blog

COVID-19 repayment amnesty over: how to avoid a bad credit rating

Blog

Fixed mortgage rates set to rise in coming months: experts

Blog, News

How do you compare: how much of your pay goes to your mortgage?

Blog

Free new mental health support service for small business owners

Blog, Small Business Loans

$15,000 HomeBuilder grant deadline fast approaching

Blog

Do you have a succession plan in place for your business?

Blog

Do you have a succession plan in place for your business?

Who would take the reins of your family business if you had to take a step back from it? Turns out just one-in-six businesses have a proper plan in place. But rest assured you can develop your own succession plan fairly painlessly, with the help of a new guide.

7 ways to make your property more attractive to potential buyers

Blog

Boom time: Australian home values surging at fastest pace in 17 years

Blog

SME credit demand improves, lenders begin next phase of COVID-19 support

Blog

Tick tock - is time running out for first home buyers?

Blog

Tick tock – is time running out for first home buyers?

The first home buyer market had a bumper year in 2020 due to modest declines in property prices, reduced investor activity, and a range of government incentives. But with those advantages tailing off, how will first home buyers compete in 2021?

“On the cusp of a boom”: CBA’s assessment of the housing market

Blog

Digital transformation: how does your business compare?

Blog

Back up for grabs: 1800 first home buyer scheme spots reissued

Blog

Record-breaking: 5 big property trends in 2021

Blog

Record-breaking: 5 big property trends in 2021

After a bumpy 2020, 2021 is already rewriting the record books. From property prices, to interest rates, to refinancing - no matter which way you look records are being broken. Today we’ll look at why property market sentiment is riding so high.

How did your suburb fare during the COVID-19 crisis?

Blog

How did your suburb fare during the COVID-19 crisis?

When coronavirus broke out across Australia, doomsday reports tipped the property market could fall as far as 30% across the country. Fortunately, that wasn’t the case. Here’s how to find out how your suburb actually fared.

How will your business bounce back from 2020?

Blog

House prices projected to jump 30% in three years: RBA

Blog

House prices projected to jump 30% in three years: RBA

It’s the document that was never meant to see the light of day. But a Freedom of Information request reveals the Reserve Bank of Australia projects a 30% increase in house prices if interest rates remain low for the next few years.

Still haven’t found what you’re looking for? Listings to pick up soon

Blog

What are Australia’s most popular vehicles? The 2020 results are in

Blog

New year, new you: 3 quick and easy finance resolutions

Blog

Happy New Year! Here’s to a prosperous 2021!

Blog

Happy New Year! Here’s to a prosperous 2021!

Well, that was a year for the history books. Time to start looking forward, we reckon! And the good news is 2021 offers plenty of promise. So what’s your New Year’s resolution?

Season’s Greetings! Bring on 2021!

Blog

Season’s Greetings! Bring on 2021!

To all our wonderful clients: this has been a year like no other, so we can only hope that you’re treated to a relaxing time with family and friends this festive season.

Warning to SMEs: payment times have completely blown out

Blog

Love thy neighbour: how to protect your home these summer holidays

Blog

Be careful of loading up on ‘buy now, pay later’ purchases this Xmas

Blog

How well do you know your finance jargon? Take our quiz!

Blog

How well do you know your finance jargon? Take our quiz!

The finance industry has a bunch of acronyms and abbreviations that can make the home buying process a little confusing. But they’re not as difficult to understand as you might think. Take our short quiz to see how many you can answer!

Freedom to move: stamp duty reforms gain momentum

Blog, News

Freedom to move: stamp duty reforms gain momentum

Stamp duty: two of the most dreaded words in the world of property and finance. Fortunately, NSW and Victoria have unveiled some big changes to the inefficient tax this week, and there’s hope it’ll inspire other states to review their own stamp duty arrangements.

8 ideas to improve your business’s cash flow over the festive season

Blog

Want to know how much your neighbours paid for their first homes?

Blog

Australia is building the biggest houses in the world once again

Blog, News

Switch lenders if rate cut is not passed on: RBA

Blog, Mortgages

RBA trims cash rate to new record low 0.10%

Blog

RBA trims cash rate to new record low 0.10%

If you didn’t back a winner on Melbourne Cup Day then fret not: the Reserve Bank of Australia (RBA) has delivered mortgage holders a win by cutting the official cash rate by 15 basis points to a new record low of 0.10%.

Housing affordability best it's been in a decade: report

Blog

Flow of credit to small businesses remains strong

Blog, Small Business Loans

Housing market confidence 'booms', cash rate cut expected

Blog

Housing market confidence ‘booms’, cash rate cut expected

Consumer sentiment is surging, confidence in the housing market is booming, and the number of experts tipping a Melbourne Cup Day cash rate cut is increasing. Let’s look at why households and businesses are becoming increasingly optimistic.

HomeBuilder sparks surge in home loans, new builds and renos

Blog, News

Turbocharged instant asset write-off scheme unveiled

Blog

Turbocharged instant asset write-off scheme unveiled

There was one big-ticket initiative in the federal budget that really caught our eye, and that was the turbocharged version of the instant asset write-off scheme. Today we’ll look at how it could improve your business’s cash flow moving forward.

The First Home Loan Deposit Scheme is back; bigger and better!

Blog, First Home Buyers

Responsible lending laws to be axed: what that means for you

Blog

JobKeeper 2.0 is about to begin: here’s what you need to know

Blog, News

JobKeeper 2.0 is about to begin: here’s what you need to know

Like most sequels, JobKeeper 2.0 won’t be as big a blockbuster as the original. But that’s not to say it won't help many SMEs navigate the difficult times ahead. Today we’ll cover what you need to know about making the transition for your business.

House prices tipped to surge 15%, RBA hints at cash rate cut

Blog, News

Is now a good time to buy property? Two-thirds of investors say ‘yes’

Blog, News

Lenders begin contacting borrowers who have deferred loans

Blog

R U OK? We’re here for you, and here’s how you can support others

Blog

How to enter the property market with a $15,000 to $30,000 deposit

Blog

More than a quarter of SME businesses knocked back for finance

Blog

There’s a good chance you have a lazy $6k lying around your home

Blog

Where you’re most likely to score a $50,000 discount on property right now

Blog, News

3 questions SME owners should ask themselves before JobKeeper 2.0

Blog, News

Applications now open for $25,000 HomeBuilder grant in all states

Blog, News

Property ranked as 'best investment option right now' by experts: survey

Blog, House Prices

Coronavirus SME Guarantee Scheme is being expanded

Blog, News

Coronavirus SME Guarantee Scheme is being expanded

If you’re a small or medium-sized business owner in need of an affordable loan then we’ve got good news: the federal government is expanding the Coronavirus SME Guarantee Scheme to allow businesses to borrow more and for a wider range of purposes.

The top ten Australian suburbs to buy in post-COVID-19

Blog, Sydney Mortgage Broker

The top ten Australian suburbs to buy in post-COVID-19

We’re all looking forward to things eventually getting back to normal, or at least the “new normal”. And while it’s not clear exactly what the “new normal” will look like in the property world, there are some promising early signs.

Homeowners refinancing in record-high numbers: explore your options

Blog

How to smooth out your business’s insurance and workers comp premiums

Blog

How to smooth out your business’s insurance and workers comp premiums

Getting a bill in the mail is never pleasant, but your annual insurance and workers compensation premiums can be particularly tough lump sums to swallow. There is, however, an affordable financing option that can limit the impact on your business’s cash flow. Let’s take a look.

$1 lenders mortgage insurance for eligible first home buyers

Blog, First Home Buyers

$1 lenders mortgage insurance for eligible first home buyers

You’ve probably heard something along the lines of ‘you need a 20% deposit to buy a home’, right? Well, not necessarily. Today we’ll look at two options available to eligible first home buyers, including a $1 lenders mortgage insurance offer that’s just been launched.

Loan deferrals to be extended for customers who need extra breathing space

Blog

Why you should care about the new ‘Open Banking’ era

Blog

Want to buy your first home with a 5% deposit and save up to $10,000?

Blog, First Home Buyers, News

Final touches on $25,000 HomeBuilder scheme announced

Blog

Last chance for $150,000 instant asset write-off this financial year

Blog, News

Best Aussie suburbs to find a "renovator's dream"

Blog

Best Aussie suburbs to find a "renovator’s dream"

Most of us have at one time dreamed of discovering a hidden little gem and renovating it into the most enviable house on the street. With the $25,000 HomeBuilder grant, those dreams are closer to becoming a reality for many. But where to look?

You might be closer to your first home deposit than you think

Blog, News

You might be closer to your first home deposit than you think

You’ve probably heard the federal government is giving $25,000 grants to eligible Australians looking to build or substantially renovate their homes. Today we’ll look at what that means for first home buyers when combined with state and territory schemes.

SMEs get instant asset write-off extension, but EOFY deadline looms

Blog, News

So, who’s eligible for the $25,000 HomeBuilder scheme?

Blog, News

So, who’s eligible for the $25,000 HomeBuilder scheme?

You might have heard that the federal government will give eligible Australians $25,000 to build or substantially renovate homes as part of the new HomeBuilder scheme. Today we’ll look at who exactly can qualify for the initiative.

How the instant asset write-off applies to vehicles

Blog

4 important upcoming business deadlines

Blog, News

4 important upcoming business deadlines

Interested in a $10,000 business grant? How about buying a much-needed asset and immediately writing off the cost? Here are four looming deadlines your business may need to start moving on ASAP.

First home loan deposit scheme reaches capacity (for now)

Blog, First Home Buyers

Goodbye stamp duty?

Blog, Taxes

Goodbye stamp duty?

The dreaded and controversial stamp duty tax could soon be a thing of the past, with calls for it to be abolished gaining momentum.

Relief for SMEs: tardy paying companies given final notice

Blog, News, Small Business Loans

Wait, the bank can do that!?

Blog, Mortgages, News

Wait, the bank can do that!?

Every now and then a bank does something that bucks the trend and takes customers by surprise. Today we’ll look at two cases that recently made national headlines and how you can reduce your chances of getting caught out.

Bank loyalty can cost existing borrowers: ACCC report

Blog, Mortgages

Making the most of the instant asset write-off before the EOFY deadline

Blog, News

4 ways we can make your life easier right now

Blog, Mortgages

4 ways we can make your life easier right now

You don’t need us to tell you how much the world has changed - there’s been no shortage of news bulletins updating you on that. So rather than telling you about more changes, today we’re going to explain how we can help.

5 reasons it’s a good time to refinance

Blog, Interest Rates, Mortgages, News

5 reasons it’s a good time to refinance

Found yourself with extra time on your hands? Slightly worried about meeting your home loan repayments? Want to make use of those back-to-back rate cuts? While the world has changed significantly over the past month, it’s possible to use some changes to your advantage.

Smaller lenders taking applications for home loan deposit scheme

Blog, First Home Buyers, Mortgages, News

How to increase your property’s value by up to 10%

Blog

Why don’t lenders drop my repayments when the interest rate falls?

Blog, Interest Rates, Mortgages

How to avoid underinsuring your home

Blog, Home Insurance

How to avoid underinsuring your home

With Australia currently enduring its worst bushfire season on record, we all want to do our little bit to help out, so today we thought we'd discuss the important topic of underinsurance.

First come, first served: first home buyer scheme now open

Blog, First Home Buyers, Mortgages, News

Season’s Greetings! Here’s to a prosperous 2020!

Blog

How to spread some free Xmas cheer these holidays

Blog

How to spread some free Xmas cheer these holidays

Did you know there’s around $1.1 billion owed to Aussie families in unclaimed shares, bank accounts and life insurance? With the festive season just around the corner, here’s how to find some long lost funds for you and your family in less than one minute.

The ‘Airbnb of pools’ splashes into Australia

Blog

The ‘Airbnb of pools’ splashes into Australia

Got a pool you’re constantly scooping leaves out of but never use? Or perhaps you’re looking to cool off this summer in the privacy of someone else’s backyard. Well, a new pool-sharing app has just launched in Australia.

SMEs in financial trouble urged to seek a helping hand early

Blog

Predatory payday lenders debt-trapping vulnerable Aussies: report

Blog

Govt moves to free-up lending for SMEs

Blog, News

Govt moves to free-up lending for SMEs

SMEs are set to have better access to finance, with the Australian government making two key moves this month to free-up lending to small business operators.

6 tips to prepare your property for valuation

Blog

Are you a spender or a saver?

Blog

Are you a spender or a saver?

Are you paid weekly, fortnightly or monthly? New research indicates that how often you’re paid has a pretty big bearing on whether you’re a saver or a spender.

Crunch time: tax debts can now be reported by ATO to credit agencies

Blog, Taxes

RBA cuts cash rate, but will the banks pass it on?

Blog, Interest Rates, Mortgages, News

Is the housing market drought finally over?

Blog, House Prices

Is the housing market drought finally over?

Marge, Marge, the rains are ‘ere! Home prices have recorded their first rise since October 2017, with national dwelling values increasing 0.8% over August, according to the latest CoreLogic report.

Ever dreamed of starting your own business?

Blog

Ever dreamed of starting your own business?

Ever been tempted to tell the boss you’re leaving to start your own business? You’re not alone. In fact, more than nine million Aussies dream about becoming their own boss.

How criminals steal your identity to steal your money

Blog

What the cash rate cuts mean for other areas of your finance

Blog, News

How to find a bank with strong corporate social responsibility

Blog, Mortgages

How to find a bank with strong corporate social responsibility

Yes, we’re well aware that this may sound like an oxymoron to some! But cheeky jokes aside, this is a question we’ve been increasingly receiving. So today we thought we’d look into what good corporate social responsibility means, and how you can find it in a bank.

Getting hounded by ATO impersonators? Don’t get scammed this tax season

Blog, Taxes

Interested in increasing your rental returns by up to 30%?

Blog

Found an account transaction error? Don’t foot the bill

Blog

7 simple ways to protect your home these Easter holidays

Blog

7 simple ways to protect your home these Easter holidays

The Easter holidays are a great time to get away with the family. Unfortunately, this means they're also a prime time for burglars to target your unoccupied home. Here are seven simple ways to deter uninvited guests from entering your property these holidays – sorry Easter Bunny!

Making the most of the instant asset write-off

Blog

Making the most of the instant asset write-off

Cash flow is like your daily hit of caffeine. You don't really notice how important it is for your business until you've got to try and operate without it. Today we'll look at how the recently expanded instant asset write-off initiative can help out in that area.

The many hats we wear

Blog

The many hats we wear

Actors act. Cleaners clean. Taxi drivers drive taxis. Mortgage brokers? Well, we don't just do mortgages. Here are the other aspects of your life we can help with when it comes to your financing options.

Top 5 tips for standing out on Airbnb

Blog

Top 5 tips for standing out on Airbnb

The short term rental market is booming. Each year, tens of thousands of Australians list their properties on Airbnb to make a tidy buck on the side. Here are our top five tips on how to stand head and shoulders above your competition.

How to choose your default Super fund

Blog

How to choose your default Super fund

Choosing the right superannuation fund can be like navigating a maze. Just when you think you're onto a winner you run into a dead end – whether that be because of high fees, hidden costs, or poor performance. Today we'll break down the process of choosing a fund in 9 simple steps.

5 ways to combat current property market conditions

Blog

5 ways to combat current property market conditions

Australia's housing market might be on a bit of a downward trajectory, but that doesn't mean the value of your home can't buck the trend. Here are five ways you can increase the value of your property, without necessarily increasing your monthly mortgage repayments.

How to avoid getting bamboozled by a pesky salesperson

Blog

How to avoid getting bamboozled by a pesky salesperson

We've all done it. In a moment of weakness, a dodgy salesperson has persuaded us to hand over our hard earned money for a purchase we didn't really need, let alone want. Here's how to politely rebuff a salesperson's pressure tactics.

Mortgages not holding Aussies back from travel

Blog

3 ways to kick your gambling habit this footy season

Blog

What are the main costs of buying a property?

Blog, Mortgages

Buying your first investment property?

Blog, Mortgages